A complete guide to AI-powered trading for beginners—compare apps like AInvest, Streetbeat, and LevelFields for smarter investing.

Trading Options with AI

Table of Contents

AI trading apps are changing the way people invest in the stock market. These tools use artificial intelligence to analyze market data, detect trading signals, and automate trading decisions.

For beginners, this means less stress, fewer mistakes, and better chances of making informed choices without needing advanced technical knowledge.

Many traders lose money because of emotional decision-making, lack of experience, or not understanding how market trends work. AI-powered trading platforms solve these issues by handling stock trading strategy execution and adjusting to changing market conditions in real time.

In this article, we will talk about how an AI trading app works and the best options available for you to choose from. We will also discuss how you can find the best opportunities to improve your investment portfolio.

AI trading apps analyze stock market trends, identify trading signals, and can automate or route trade orders via connected brokerage accounts. These apps use machine learning and AI models to track price movements, financial reports, and industry trends.

AI can use this data to make predictions and adjust trading strategies based on market activity.

AI trading apps gather data from various sources, including:

Studying this information allows AI pattern recognition systems to detect patterns that might indicate future price movements. Traders can use it to make informed choices without the need for advanced technical knowledge.

AI trading software looks for signals that suggest when to buy or sell stocks. These signals are based on historical data, technical indicators, and past market trends.

An AI stock trading bot detects shifts in trading volume, stock price movements, and investor behavior to suggest the best time to enter or exit a trade. You can use it to reduce guessing and increase the chances of making better trades.

Many AI trading apps allow traders to set specific trading rules for buying and selling. These rules can be based on:

Once these conditions are met, the AI executes the trade automatically. It also removes the need for traders to constantly monitor the market.

For example, a trader might set a rule to buy a stock when its price drops to a certain level. The AI system watches the market and buys the stock when it reaches that price.

Traders use this to follow their investment strategy without having to make every decision manually, then handle executing trade orders through a brokerage account.

Before using a trading strategy in real time, AI trading bots often rely on backtesting with historical data to evaluate how the strategy would perform under different market conditions.

AI uses historical data to simulate trades, support strategy creation, and measure success rates. Testing strategies in this way can help traders adjust their approach before investing real money.

AI trading apps often include reports that help traders review past performance. These reports can:

Traders looking at past results can adjust their approach and learn from mistakes. AI also tracks overall market performance, which helps traders stay informed about long-term trends.

Financial markets move quickly, and AI trading apps are designed to react to these changes. If market conditions shift, AI can adjust its trading approach based on new data, including identifying potential reversal setups.

You can use this to stay ahead of trends without constantly analyzing charts. AI also detects risks and can pause trading or make changes to protect investments during volatile markets.

Many traders make mistakes because of emotions. Fear and excitement often lead to poor decisions, such as selling too soon or buying at the wrong time.

AI tools remove these emotions from trading by following a set of rules based on data. Trading will also become more consistent, and traders can avoid decisions driven by impulse rather than logic.

Choosing the best AI trading app for beginners depends on ease of use, automation features, and how well it supports your preferred trading style.

AI-powered trading platforms help traders make informed decisions by providing trading signals, real-time market analysis, and automated execution.

Below are the top five AI trading apps that provide useful tools for those new to trading stocks and other assets.

AInvest provides a complete AI trading platform with tools for stock selection across shares and exchange-traded funds, market research, and trade execution. The platform’s AIME+ AI engine generates stock picks, identifies market trends, and offers personalized trade recommendations.

Users can explore AI-powered investment strategies such as Magic Portfolio, Magic Day Trading, and Magic Signal to help them trade stocks more confidently. The AIME Copilot provides real-time insights and helps traders make rational investment decisions.

AInvest also integrates with major brokers to execute trades directly through the platform. It also offers 24/7 market alerts, premium research tools, and an AI-driven portfolio tracker for performance evaluation.

Streetbeat provides AI-powered trading insights by offering a team of AI agents that help traders manage investments. These AI agents analyze market data, research financial reports, and create custom portfolios with thoughtful asset allocation based on the user’s preferences.

This platform focuses on thematic investing to pick portfolios that align with personal interests. Trending portfolios include the U.S. Congress Buys, which tracks stocks purchased by members of Congress, and the Generative AI Revolution, which invests in companies involved in AI development.

Users can automate portfolio rebalancing, schedule recurring investments, and track real-time market trends using sentiment analysis tools. Streetbeat also offers a commission-free trading experience with a subscription-based model.

MetaTrader 5 is one of the most popular trading platforms and CFD trading, offering advanced tools and automated trading bots for both beginners and seasoned traders.

The platform offers 38 indicators and 44 analytical tools, which makes it useful for analyzing market data. Multiple order types and execution modes also provide flexibility in trading decisions for technical traders.

MetaTrader 5 also supports AI-powered trading bots and includes an economic calendar and financial news updates to keep active traders informed about market events that could impact prices.

Aside from the mobile app, it also supports desktop and web versions to provide traders access from anywhere.

WunderTrading is a trading platform that enables users to leverage trade automation and follow successful traders. The platform provides trading bots and uses trading algorithms for automating trades across multiple exchange accounts from one interface.

With support for TradingView automation, users can turn TradingView scripts into fully functional crypto trading bots and build custom strategies. WunderTrading also offers free pre-built trading bot scripts that can be activated in a few steps.

The platform integrates with major crypto exchanges, including Binance, Coinbase Pro, Kraken, and KuCoin, helping traders automate strategies across multiple asset classes. Users can also engage in copy trading to follow the strategies of experienced traders.

Capitalise is an AI-powered trading platform that allows traders to create and automate strategies without coding. Users can write their trading plans in everyday English, and the platform executes even complex strategies automatically.

This platform includes sophisticated trading tools for backtesting, real-time market scanning, and custom alerts. Capitalise also monitors financial data, technical indicators, and macroeconomic events around the clock.

It helps traders automate decisions without constant market tracking.

Investing in the stock market requires research, analysis, and planning that even hedge funds rely on when building positions.

The right trades are those that align with a well-thought-out strategy, balancing risk and reward while considering short-term movements and long-term potential.

Traders follow market trends to understand whether stocks are moving up, down, or staying within a range. Recognizing these patterns helps in choosing the right time to buy or sell.

Tracking trends requires watching:

When combined with a structured approach, traders can make more informed choices.

AI-powered trading systems analyze market data to surface trading ideas that human traders might overlook. These systems process real-time stock movements, trading volume, and news reports, providing insights that help traders make decisions faster.

Automated screening tools filter stocks and crypto assets based on price changes and momentum, while traders backtest strategies using historical data. AI-driven alerts notify traders when stocks reach predefined levels to help them act quickly.

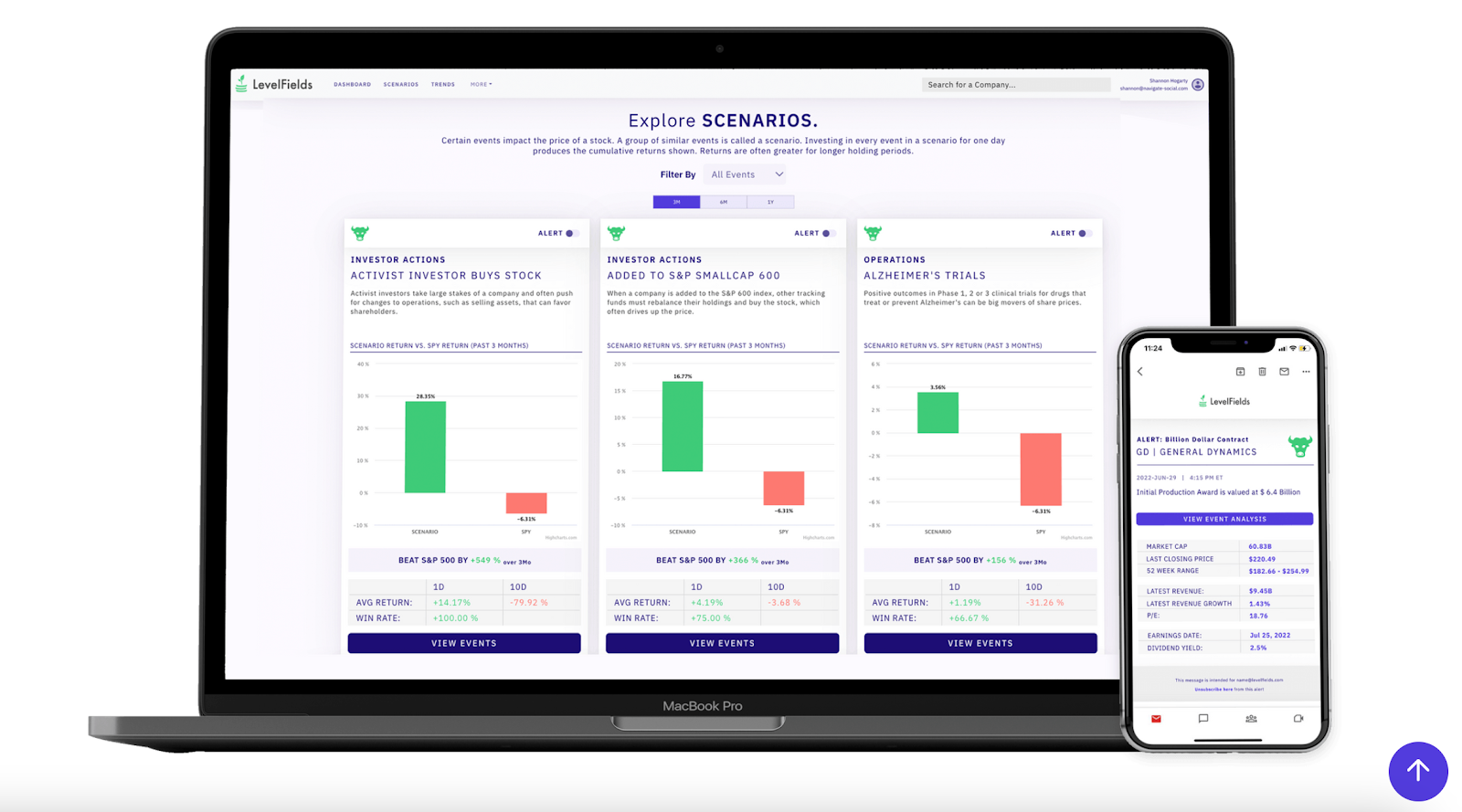

LevelFields is a platform that uses AI to analyze news reports, financial filings, and other market data to identify events that may influence stock prices. The platform scans millions of data points to provide insights on how past events have impacted stocks.

Traders can set up custom scenarios based on factors such as leadership changes or regulatory updates. This helps investors focus on events that match their strategy rather than scanning an overwhelming amount of information.

Its AI alerts notify users of important market developments and help them react quickly. The platform also includes watchlists for tracking stocks and access to over 100 trading strategies to support market awareness.

Find the best trades possible with LevelFields. Sign up now!

Technical analysis focuses on studying past price movements and patterns to predict future performance. Traders rely on charts and indicators to measure momentum, volatility, and entry or exit points.

While technical analysis requires practice and can involve a steep learning curve, AI-powered trading platforms simplify the process by scanning large amounts of data in seconds. It allows traders to take advantage of opportunities with better timing and confidence.

For those interested in long-term investing, studying a company’s financial health is an important step. Earnings reports provide insight into profitability, while revenue growth shows whether a business is expanding.

Industry performance also plays a role in identifying promising stocks. Some sectors grow faster than others, and investing in industries with long-term potential may lead to better returns.

Analyzing these factors helps investors refine their long-term investment strategies and make choices based on a company’s financial strength.

No trade comes without risk, which is why managing exposure is a key part of a trading strategy. One method is to set stop-loss orders, which automatically exit a trade when a stock reaches a certain price.

Building a diversified portfolio across multiple stocks or sectors reduces the effect of poor performance in a single area. Position sizing, or limiting the amount of money placed in one trade, also helps control overall risk.

Risk management is about maintaining balance. While AI-powered tools provide valuable insights, traders still need to trade with discipline, and a clear strategy will help them avoid unnecessary losses.

Looking to improve your investment strategy? LevelFields gives you access to advanced analytics that help you identify opportunities 1,800 times faster.

It analyzes over 1.8 million market events each month to deliver data-backed insights so you can make informed decisions instead of relying on speculation. Trading should be based on facts, not guesswork, and no platform is a money machine.

Sign up today and start turning market insights into profits!

The best AI trading platform for beginners is one that offers automated tools, clear dashboards, and a free tier to explore before upgrading. Platforms like AInvest and Streetbeat simplify stock selection and swing trading without requiring technical experience.

They use algorithms and an AI bot to analyze patterns, generate signals, and support smarter decision-making.

Yes. AI trading helps beginners reduce emotional decisions and follow proven strategies tested through backtesting. Most platforms include educational resources so new traders can learn how to interpret signals and refine their approach.

Using an integrated brokerage account with providers such as Interactive Brokers also ensures secure execution and regulated trading.

Yes. Several trading apps use real artificial intelligence for data analysis and automation. These apps combine predictive models and multiple bots to manage trades across assets efficiently.

They use AI-driven market analysis to track trends and adjust portfolios in real time, making them some of the best AI tools for hands-off investing while still allowing users full control over trades.

The best trading approach for beginners is a structured plan supported by automation and clear risk controls. Start small, use demo accounts, and rely on platforms that offer AI insights, educational resources, and step-by-step guidance.

Over time, learning through these tools builds discipline and confidence in managing real trades safely, including short-term methods like swing trading.

Join LevelFields now to be the first to know about events that affect stock prices and uncover unique investment opportunities. Choose from events, view price reactions, and set event alerts with our AI-powered platform. Don't miss out on daily opportunities from 6,300 companies monitored 24/7. Act on facts, not opinions, and let LevelFields help you become a better trader.

AI scans for events proven to impact stock prices, so you don't have to.

LEARN MORE