Meta secured $29B from Pimco and Blue Owl for a Louisiana AI data center, signaling mega-cap reliance on private credit.

Sectors & Industries

Table of Contents

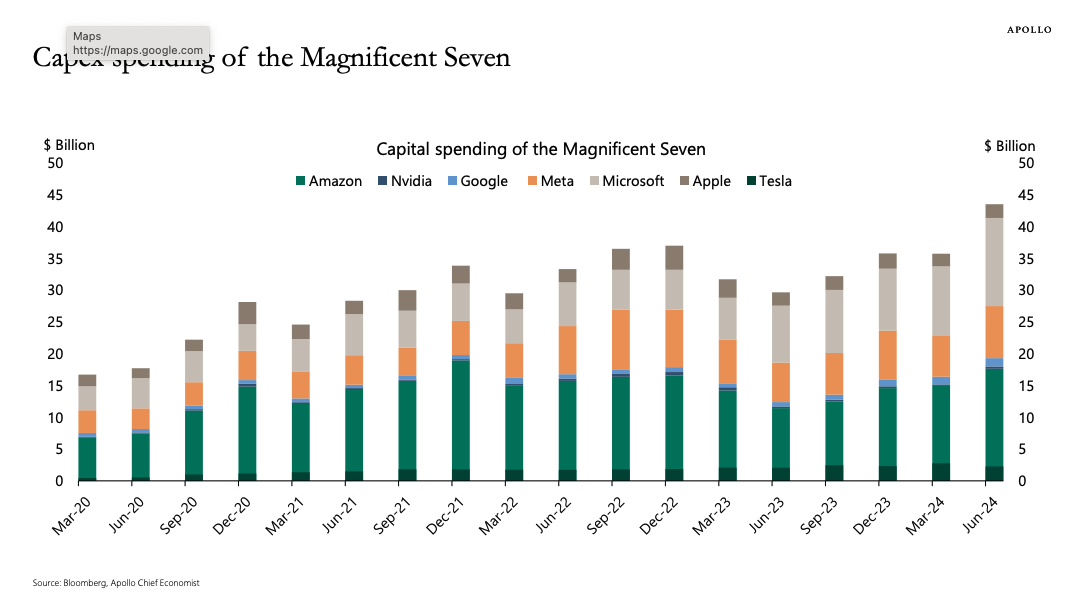

The scale of AI capex has become so large that even mega-cap balance sheets are looking outside public markets to keep spending. Meta just tapped Pimco and Blue Owl for $29 billion in financing to fund a massive Louisiana data center build—$26 billion in debt and $3 billion in equity—after a hiring spree that poached niche AI talent from competitors at price tags running into the hundreds of millions per head. This comes on top of similar private capital partnerships by Microsoft and Elon Musk’s xAI, proving that the AI race is driving expenditures and borrowing. For investors, the pivot to private credit is a risk that cash burn could eventually outpace returns if revenue growth doesn’t scale fast enough.

Join LevelFields now to be the first to know about events that affect stock prices and uncover unique investment opportunities. Choose from events, view price reactions, and set event alerts with our AI-powered platform. Don't miss out on daily opportunities from 6,300 companies monitored 24/7. Act on facts, not opinions, and let LevelFields help you become a better trader.

AI scans for events proven to impact stock prices, so you don't have to.

LEARN MORE