Use cash-secured puts to build wealth over time by combining premium income with disciplined stock ownership.

Sectors & Industries

Table of Contents

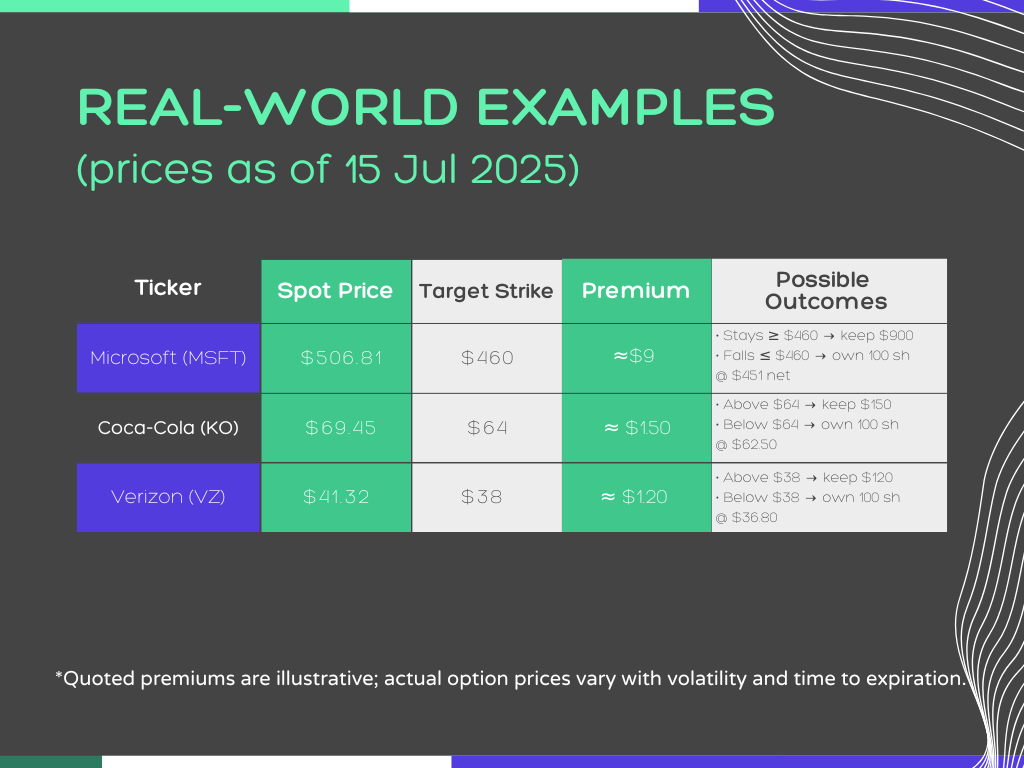

The setup (updated 15 July 2025) – Apple now trades around $210 per share. You’d love to own it at $180. Instead of waiting and earning nothing, you sell a cash-secured put at the $180 strike and collect roughly $4 per share in premium. If Apple dips to $180, you’re assigned and buy 100 shares at your target price. If it doesn’t, you keep the $400 and can try again next month.

That’s the beauty of cash-secured puts—you get paid to wait.

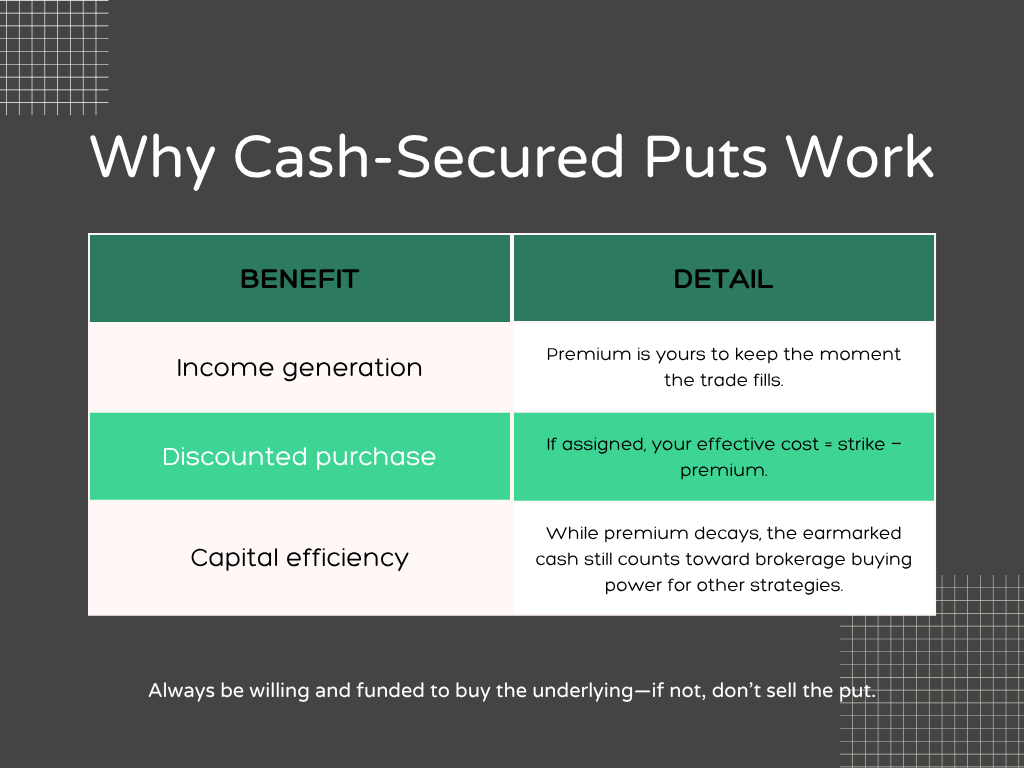

A cash-secured put (CSP) is an options strategy in which you:

It’s like getting paid to place a standing limit order below the market.

Stick with blue-chips you’d happily hold for years. Liquid options and solid fundamentals are must-haves.

Pick a level you’re comfortable owning 100 shares. Use valuation metrics, technical support or dollar-cost-average plans.

Confirm cash available (strike × 100), sell the put, collect premium, and manage as the stock moves.

Because these are advanced techniques, be prepared to invest time mastering the exact mechanics of each before you put them into practice.

.png)

.png)

There's a lot that goes into setting up a cash secured put and then managing your position effectively. While tools like TradingView and Seeking Alpha can help you with various parts of the process, LevelFields AI is, in our opinion, the best tool for the comprehensive approach that combines everything you need to set up and manage CSP positions successfully.

LevelFields AI provides the complete package for cash secured put traders. The platform tracks various events like earnings beats, share buybacks, and dividend increases that can significantly impact option premiums and create ideal CSP opportunities. Rather than manually monitoring dozens of stocks for the right setup conditions, LevelFields identifies when companies experience the catalysts that typically drive the volatility and price movements that make CSP strategies most profitable.

The platform's backtested data shows you historically how stocks react to specific events, helping you time your CSP entries when you're most likely to either keep the premium or acquire shares at attractive prices. This systematic approach beats trying to guess when stocks might pull back to your target strike prices.

Patience is vital—great CSPs come after sell-offs or volatility spikes. View assignment as success, not failure: you’re now long a quality stock at a discount and can pivot to covered calls.

Limit total CSP exposure to 10-20 % of your overall portfolio so the strategy supplements—rather than dominates—your asset mix.

Cash-secured puts let you earn steady option income and acquire beloved stocks at bargain prices. By focusing on high-quality companies, selecting rational strikes, and practicing disciplined risk management, you transform idle cash into an active, yield-generating component of your long-term investing plan.

Get paid to wait, or get paid and own the stock—either outcome can build wealth over time.

Join LevelFields now to be the first to know about events that affect stock prices and uncover unique investment opportunities. Choose from events, view price reactions, and set event alerts with our AI-powered platform. Don't miss out on daily opportunities from 6,300 companies monitored 24/7. Act on facts, not opinions, and let LevelFields help you become a better trader.

AI scans for events proven to impact stock prices, so you don't have to.

LEARN MORE