Government spending jumped 10% in July while revenues lagged, driving deficits and record debt interest payments.

Sectors & Industries

Table of Contents

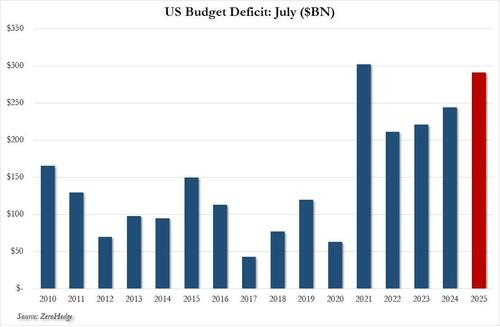

Tariffs are now bringing in nearly $20B per month—about $240B annually—but spending is rising far faster. July U.S. federal government spending jumped to $630B, up almost 10% YoY, while revenues gained just 2.5%. The result was a $291B deficit, the second-worst July on record and a reversal from June’s brief surplus. Year-to-date, the deficit has already hit $1.63T, putting 2025 on pace to be the third-worst fiscal year in U.S. history.

The burden of debt service is accelerating even faster: the U.S. paid $92B in July interest alone, pushing the year-to-date total over $1T—already larger than defense spending. With debt costs set to exceed $1.2T this year, fiscal pressures are reinforcing inflation just as PPI, core CPI, and electricity costs reheat.

Join LevelFields now to be the first to know about events that affect stock prices and uncover unique investment opportunities. Choose from events, view price reactions, and set event alerts with our AI-powered platform. Don't miss out on daily opportunities from 6,300 companies monitored 24/7. Act on facts, not opinions, and let LevelFields help you become a better trader.

AI scans for events proven to impact stock prices, so you don't have to.

LEARN MORE